Creating Passive Income Streams: A Guide for Solopreneurs

Estimated reading time: 6 Min

What is creating passive income streams all about? What exactly is it, why is it so vital for solopreneurs like us, and how do we create them?

It’s living the dream!

If this is your dream, then passive income is money you earn without having to work actively for it all the time.

This is different from active income, where you trade your time directly for money, like freelancing, consulting, or taxi driving, perhaps!

It’s the income that flows in while you focus on other things or even while you sleep.

For solopreneurs, passive income streams offer stability, diversity and financial security, helping to weather the ups and downs of solo business life.

Imagine having multiple sources of income trickling in, reducing your reliance on a single stream, and providing a safety net during lean times.

This diversification can make your financial situation more robust and less stressful.

However, it’s essential to understand that creating passive income streams requires upfront effort and commitment.

It’s not a get-rich-quick scheme but a long-term strategy that pays off over time.

Let’s dive into how you can start creating passive income streams.

Identifying Your Passive Income Avenue

First, assess your skills and interests.

What do you enjoy doing?

What are you good at?

Your passions and expertise can guide you towards the most suitable passive income opportunities.

If you love writing, consider creating e-books or online courses.

If you’re tech-savvy, maybe developing an app is your calling.

Next, conduct market research to find viable passive income options.

Look at trends, demand, and competition in your chosen area.

Use tools like Google Trends, keyword planners, and social media insights to gauge interest and potential profitability.

Low-investment opportunities are ideal for those starting out.

These include blogging, affiliate marketing, and creating digital products, which often require more time than money initially.

Leveraging your existing business or profession can also be a goldmine.

For instance, a consultant could offer downloadable templates or a photographer might sell stock photos online.

Digital Products: E-books, Courses, and More

Creating digital products is one fantastic way to earn passive income.

E-books, online courses, templates, and “printables” are all examples.

These products can be created once and sold repeatedly, generating income with minimal ongoing effort.

Focus on creating evergreen content—material that remains relevant over time.

This ensures that your product continues to sell well into the future.

For example, a course on basic accounting principles will likely remain relevant for years, whereas a guide to the latest software might become obsolete quickly.

Automate distribution through platforms like Amazon for e-books, Teachable for courses, or Etsy for printables (or digital downloads), which are items that you can download immediately after buying them online and print at home.

These platforms handle sales, payments, and delivery, freeing you to focus on creating more content.

Ensure your content offers real value to the community to keep customers satisfied and coming back for more.

High-quality, helpful products build trust and encourage word-of-mouth referrals.

Affiliate Marketing: Earning While You Sleep

Affiliate marketing is another excellent avenue.

This involves promoting other people’s products and earning a commission on sales made through your referral.

It’s a straightforward way to earn passive income, especially if you already have an online presence.

Choose affiliate programmes that align with your preferred niche or audience.

Promote these products through blogs, social media, or email marketing.

Provide honest reviews and helpful information to encourage your audience to make a purchase.

Remember to maintain transparency and trust with your audience by only endorsing products you genuinely believe in.

Disclose your affiliate relationships clearly to build credibility and avoid misleading your followers.

Ad Revenue and Sponsored Content

If you have a website or a strong social media presence, you can monetize your traffic through ad revenue.

Google AdSense and other ad networks can pay you based on the number of views or clicks on ads displayed on your site.

This can be a steady source of passive income if you have significant web traffic.

Additionally, developing sponsorships and partnerships can be lucrative.

Brands may pay you to promote their products or create sponsored content.

Balance content integrity with sponsored messages to keep your audience engaged and authentic.

Always negotiate fair compensation for the value you provide to sponsors.

Make sure the partnerships align with your brand and provide value to your audience.

Investing in Revenue-Generating Assets

If you have spare capital, consider investing in revenue-generating assets like real estate or dividend stocks.

These can provide steady income over time and grow your wealth without active involvement.

Real estate can offer rental income, while dividend stocks provide regular payouts from profitable companies.

The power of compound interest is your friend here.

Reinvesting your earnings can exponentially grow your wealth over time.

For beginners, Robo-advisors like Betterment or Wealthfront can be a good way to get started with investing.

They manage your investments automatically, making it easier to grow your portfolio with minimal effort.

Always employ risk-management strategies to protect your investments; you can lose as well as win!

Diversify your portfolio to spread risk and avoid putting all your money into a single asset.

Stay informed about market conditions and adjust your strategy as needed.

FAQs: Creating Passive Income Streams

How much can I realistically earn from passive income?

Earnings vary widely based on effort, niche, and market conditions. Some solopreneurs earn a modest supplementary income, while others make enough to replace their active income.

What are some red flags for passive income scams?

Beware of promises of quick, effortless wealth, high upfront fees, or lack of transparency. Do thorough research before investing time or money.

How much time commitment is needed to maintain passive income?

Initial setup can be time-consuming, but maintenance usually requires less effort. Regular updates and customer interaction may be needed, depending on the source of the income stream.

What are the tax implications of passive income?

Passive income is subject to taxes, which vary by country. Consult a tax professional to understand your obligations and maximise your earnings.

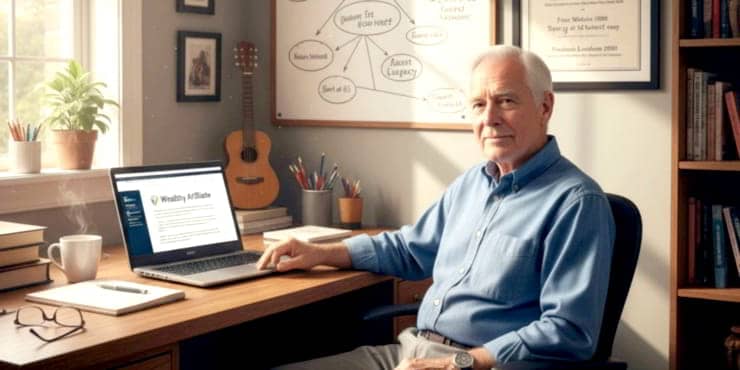

How can I learn to build a website?

There are many ways to learn; some are free, including this post: “The Ultimate Guide to Building Your First WordPress Website Step-by-Step.” I recommend checking out Wealthy Affiliate because it provides training and tools on how to build a business online, how to build a website using WordPress, provides hosting and technical training where needed, and has fostered an enormous, knowledgeable, and supportive community.

Summary: Stepping Stones to Financial Freedom

Building passive income streams takes time, patience, and resilience.

It’s not an overnight process but a gradual journey towards financial freedom.

Keep learning, adapting, and exploring new opportunities.

Start small, stay consistent, and you’ll see the fruits of your efforts over time.

Need more help?

Just ask in the comments or via the contact form.

😉

Richard

Useful Resources

- Books: “Rich Dad, Poor Dad” by Robert Kiyosaki, The Intelligent Investor by Benjamin Graham

- Courses: Earn Passive Income with E-books on Udemy; Investing for Beginners on Coursera

- Websites: Wealthy Affiliate is a great place to learn all that you need!

By diversifying your income streams, you can achieve greater financial stability and freedom as a solopreneur. Happy earning!

![Are Wealthy Affiliate Hubs Revolutionising Website & Content Development In [year]? A futuristic and sleek digital workspace designed for website management and content creation - Wealthy Affiliate Hubs](https://ml0yvzumdtic.i.optimole.com/cb:k6B_.1fa14/w:740/h:370/q:mauto/https://solobusinessmind.com/wp-content/uploads/2024/12/A-futuristic-and-sleek-digital-workspace-designed-for-website-management-and-content-creation-Wealthy-Affiliate-Hubs740x370-O.jpg)